how to take an owner's draw in quickbooks

Glossary of construction terms acronyms keywords and phrases for construction management as well as construction project management language and software definitions specific to the Procore. She could choose to take some or even all of her 80000 owners equity balance out of the business and the draw amount would reduce her equity balance.

How To Record An Owner S Draw The Yarny Bookkeeper

There are many factors to weigh before you leave an inheritance to your children and not all are related to taxes.

. Dont miss out on the full benefits of your Paycheck Protection Program PPP loan. In this third course you will learn about liability and equity accounts and its effect on the balance sheet. 2022 complete list of small-business tax deductions.

Costs Its simple mathyou cant profit if youre spending more than you bring in. How to pay yourself as a business owner. Whether you are a small bar operation or a multi-location restaurant chain we can help you take your concept to the next level.

If fully forgiven youll owe 0. But we dont draw the line at simply educating readers. Were also here to help you finance your small business dreams.

Also you cannot deduct the owners draw as a business expense unlike salary. So if you are a sole proprietor a partner or an LLC you can go for the owners draw. If youre looking for information about Merchant Maverick grants or want to apply for one of our Opportunity Grants youve come to the right place.

Mon Dec 14 2020. We know what you deal with day in and day out and how to make your life easier. 6 steps you need to take.

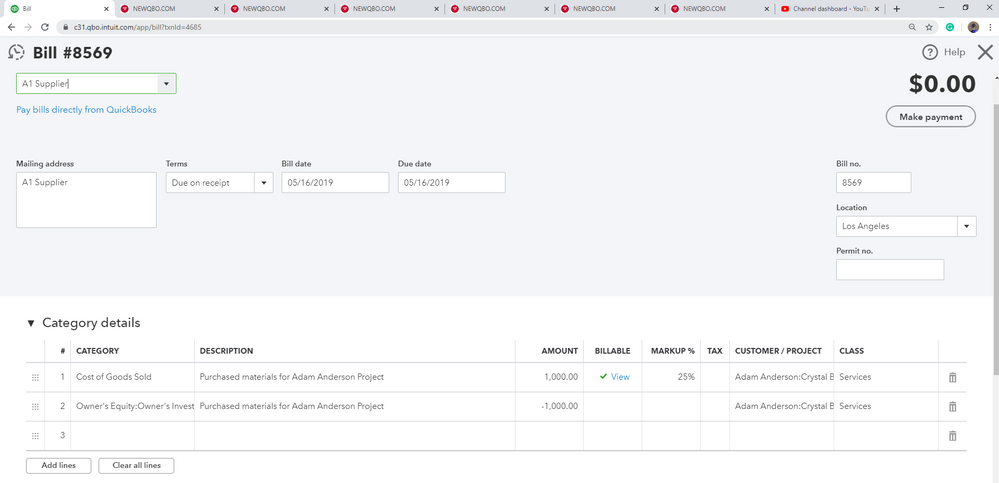

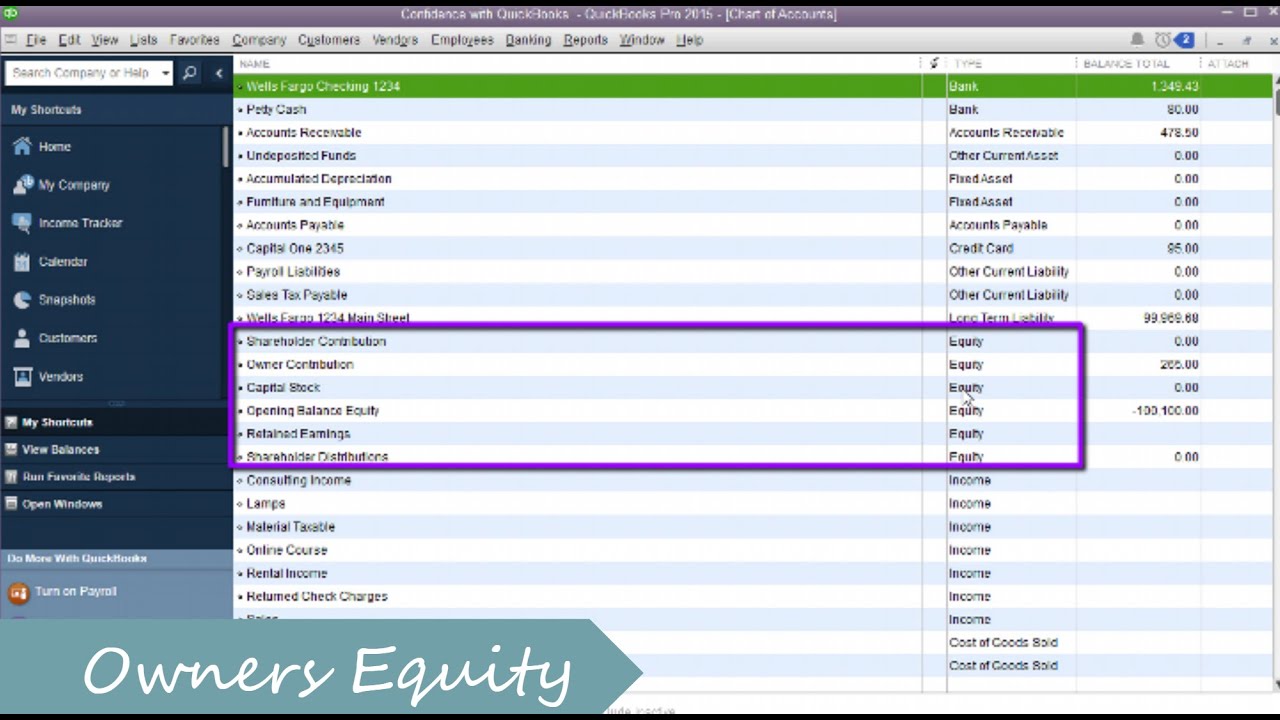

If youre using an accounting program like QuickBooks you want to look for an owners equity account called something like dividends or distributions or draws to use for shareholder dividend or distribution payments. The owners draw is the distribution of funds from your equity account. Always take note of any major differences that allow you to be more flexible on your price.

This leads to a reduction in your total share in the business. As specialists we can draw on hundreds of similar operations and years of experience to help you avoid pitfalls and make more money. Learn more about some of the issues.

Always take into consideration production costs how much it costs to produce a product or. Sat Jan 08 2022. If you have mastered bookkeeping basics and understand accounting assets you are ready to jump into Liabilities and Equity in Accounting.

Owners equity is also where a family living or draw account would be located if the business is providing for personal needs of the owners and an owners contribution account to capture contributed capital situations. Forgiveness is open now for all first and second PPP loans so apply today and avoid worrying about it later.

How To Pay Invoices Using Owner S Draw

How To Record Owner S Equity Draws In Quickbooks Online Youtube

Quickbooks Owner Draws Contributions Youtube

How Do I Make A J E With A Cr To Owner S Draw And Properly Record It In Cog Sold I Am Using Qbo Adv I Bought Items With My Personal Money That

How To Setup And Use Owners Equity In Quickbooks Pro Youtube